good bookkeeping

The Essential Elements of Good Business Bookkeeping:

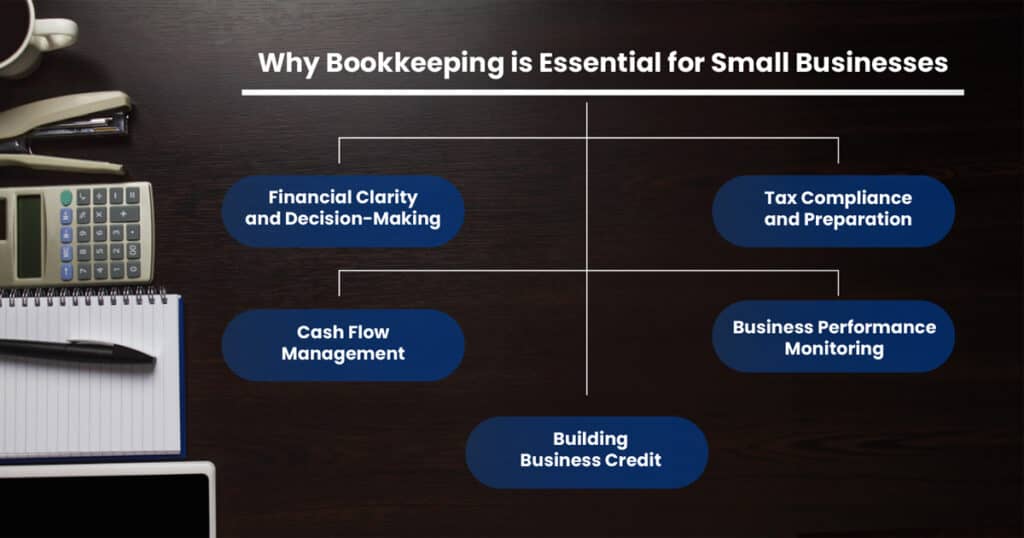

Effective bookkeeping is the backbone of any successful business. It provides crucial insights into your company’s financial health and helps you make informed decisions. Let’s explore the key elements that constitute good business bookkeeping practices.

Accurate and Timely Record-Keeping

The foundation of good bookkeeping is maintaining accurate and up-to-date records of all financial transactions. This includes:

- Recording all income and expenses promptly

- Categorizing transactions correctly

- Reconciling bank statements regularly

- Keeping track of accounts payable and receivable

Timely record-keeping ensures that you always have a clear picture of your business’s financial status and helps prevent errors that can compound over time.

Proper Account Structure

A well-organized chart of accounts is crucial for effective bookkeeping. This involves:

- Creating a logical account structure that fits your business

- Grouping accounts into meaningful categories (assets, liabilities, equity, income, expenses)

- Using consistent naming conventions for accounts

- Regularly reviewing and updating the account structure as your business evolves

A properly structured chart of accounts makes it easier to categorize transactions and generate useful financial reports.

Consistent Accounting Method

Choosing the right accounting method and applying it consistently is vital. The two primary methods are:

- Cash-basis accounting: Recording transactions when cash changes hands

- Accrual-basis accounting: Recording transactions when they occur, regardless of when payment is received or made

The choice depends on your business size, industry, and reporting requirements. Consistency in applying your chosen method ensures accurate financial statements and compliance with tax regulations.

Regular Reconciliation

Reconciliation is the process of comparing your internal financial records with external statements, such as bank statements. Regular reconciliation:

- Helps identify discrepancies or errors

- Ensures all transactions are accounted for

- Provides an accurate picture of your cash position

- Helps detect potential fraud or unauthorized transactions

Aim to reconcile your accounts at least monthly to maintain accurate books.

Proper Documentation

Maintaining organized and complete documentation is crucial for good bookkeeping. This includes:

- Keeping receipts for all expenses

- Storing invoices for sales and purchases

- Maintaining records of financial statements and tax filings

- Documenting your bookkeeping processes and procedures

Proper documentation not only supports your financial records but will also prove invaluable during audit or tax inquiries.

Regular Financial Reporting

Generating and reviewing financial reports regularly is a key element of good bookkeeping. Essential reports include:

- Income Statement (Profit and Loss)

- Balance Sheet

- Cash Flow Statement

- Accounts Receivable and Payable Aging Reports

These reports provide insights into your business’s performance, financial position, and areas that may need attention.

Separation of Personal and Business Finances

For small business owners, it’s crucial to maintain a clear separation between personal and business finances. This involves:

- Using separate bank accounts for business and personal transactions

- Avoiding the use of business funds for personal expenses

- Properly documenting any capital contributions or withdrawals

This separation simplifies bookkeeping, ensures accurate financial reporting, and can provide legal protection in some cases.

Embracing Technology

Modern bookkeeping benefits greatly from technology. Consider:

- Using cloud-based accounting software for real-time access to financial data

- Implementing automated data entry tools to reduce errors and save time

- Utilizing expense tracking apps to capture and categorize expenses on the go

Leveraging technology can significantly improve the efficiency and accuracy of your bookkeeping processes.

Regular Review and Improvement

Good bookkeeping is an ongoing process that requires regular review and refinement. This includes:

- Periodically assessing your bookkeeping practices for efficiency and accuracy

- Staying informed about changes in accounting standards and tax regulations

- Seeking professional advice when needed

- Continuously educating yourself or your team on best practices

By incorporating these elements into your bookkeeping practices, you’ll create a solid financial foundation for your business. Good bookkeeping not only ensures compliance with legal and tax requirements but also provides the insights needed to drive your business forward. Remember, while technology can greatly assist in bookkeeping tasks, understanding these fundamental elements is key to maintaining the financial health of your business.

If this strikes a chord with you, you are one click away from finding a better path. https://www.freedomsgood.com/accounting